Get solutions on your questions on a 444 Credit Score under. Editorial and consumer-produced content material is just not presented, reviewed or endorsed by this issuer.

Keep away from superior credit history utilization prices. Attempt to keep the utilization throughout all of your accounts under about 30% in order to avoid decreasing your score.

The lender may be able to help you take care of it ahead of the late payment is included for your stories. But when it has been accurately described, a late payment is often tricky to remove from your credit studies.

At WalletHub, we try to checklist as quite a few credit card features as you possibly can and at the moment have over one,500 delivers, but we do not record all accessible delivers or fiscal service providers.

Take note: It might be possible to qualify for an unsecured credit card, private loan, automobile loan or dwelling loan in scarce circumstances, even so the phrases are not likely to get worthwhile. If you submit an application for the average present, you’re a lot more prone to be turned down than approved.

And you can even have a number of credit history reports. The knowledge utilized to compute your credit rating scores can come from distinct reports, designed by a variety of credit rating agencies, including the 3 principal client credit rating bureaus (Equifax, Experian and TransUnion).

Owning weak credit score scores can make it a battle to get permitted for unsecured credit history. But in case you give attention to constructing your credit history eventually, you’ll very likely begin to qualify For additional delivers with much better terms and charges.

Composed by: Casey Hollis Editorial Notice: Intuit Credit rating Karma gets payment from 3rd-party advertisers, but that doesn’t have an impact on our editors’ opinions. Our 3rd-celebration advertisers don’t assessment, approve or endorse our editorial information. Information regarding economical merchandise not presented on Credit rating Karma is gathered independently. Our written content is exact to the best of our know-how when posted.

Experian as well as Experian emblems made use of herein are emblems or registered trademarks of Experian and its affiliate marketers. The use of every other trade title, copyright, or trademark is for identification and reference purposes only and would not suggest any association Along with the copyright or trademark holder in their solution or more info model.

We demonstrate a summary, not the entire authorized conditions – and right before applying you should understand the complete phrases of your provide as stated with the issuer or spouse itself. When Experian Customer Providers takes advantage of affordable endeavours to existing quite possibly the most correct facts, all present facts is offered without having warranty.

Late and missed payments and accounts deemed delinquent will harm your credit history score. A steady record of on-time payments may help your credit rating rating. This tends to account for as much as 35% of one's FICO® Rating.

Lots of lenders see shoppers with scores from the Really Very poor array as possessing unfavorable credit rating, and could reject their credit score programs.

Determining precisely what goes into your credit history scores might be intricate. With all the various credit history aspects — like payment record plus the age and quantity of your accounts — which will make up Each individual credit score, there’s no one method to Establish your credit. The path that’s ideal to suit your needs depends on your precise credit profile.

Secured playing cards are exceptional in which they involve people to place a refundable security deposit, the level of which serves as their expending Restrict. This shields issuers from danger, which allows them to charge minimal costs and give practically guaranteed acceptance.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Mike Vitar Then & Now!

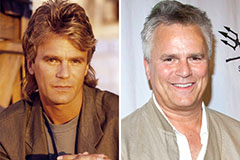

Mike Vitar Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!